Let’s take a closer look at today’s altcoins showing breakout signals. We’ll explain what the coin is, then dive into the trading charts and provide some analysis to help you decide.

1. Eos (EOS)

EOS is a platform that’s designed to allow developers to build decentralised apps. The project’s goal is relatively simple: to make it as straightforward as possible for programmers to embrace blockchain technology and ensure that the network is easier to use than rivals. As a result, tools and a range of educational resources are provided to support developers who want to build functional apps quickly. EOS also aims to improve the experience for users and businesses. While the project tries to deliver greater security and less friction for consumers, it also vies to unlock flexibility and compliance for enterprises.

EOS Price Analysis

At the time of writing, EOS is ranked the 39th cryptocurrency globally and the current price is A$5.25. Let’s take a look at the chart below for price analysis:

EOS’s nearly 83% drop from its May highs found a low near A$4.64 in July before closing over a short-term high around A$7.26 last week.

This daily close over the high could signal a shift in market structure that might reach probable resistance near A$7.56. A sustained bullish move may target the swing high at A$8.14. If this stop run occurs, a run beyond the high into probable resistance near A$8.35 and A$8.79 is possible.

Bulls could buy a retracement to possible support near A$5.02, just above the monthly open. A bearish turn in the marketplace may propel the price toward possible support near A$4.75.

However, relatively equal lows near A$4.52 and A$4.34 provide an attractive target for bears if the market resumes its bearish trend. A run on these lows might find support between A$4.15 and A$3.90.

2. Alpha Finance (ALPHA)

Alpha Finance Lab APLHA is a cross-chain DeFi platform that looks to bring alpha to users across a variety of different blockchains, including Binance Smart Chain (BSC) and Ethereum. The platform aims to produce an ecosystem of DeFi products that address unmet needs in the industry while remaining simple to use and access. ALPHA is the native utility token of the platform. Token holders can earn a share of network fees by staking ALPHA tokens to cover any default loans. Other use cases for the token include liquidity mining and governance voting.

ALPHA Price Analysis

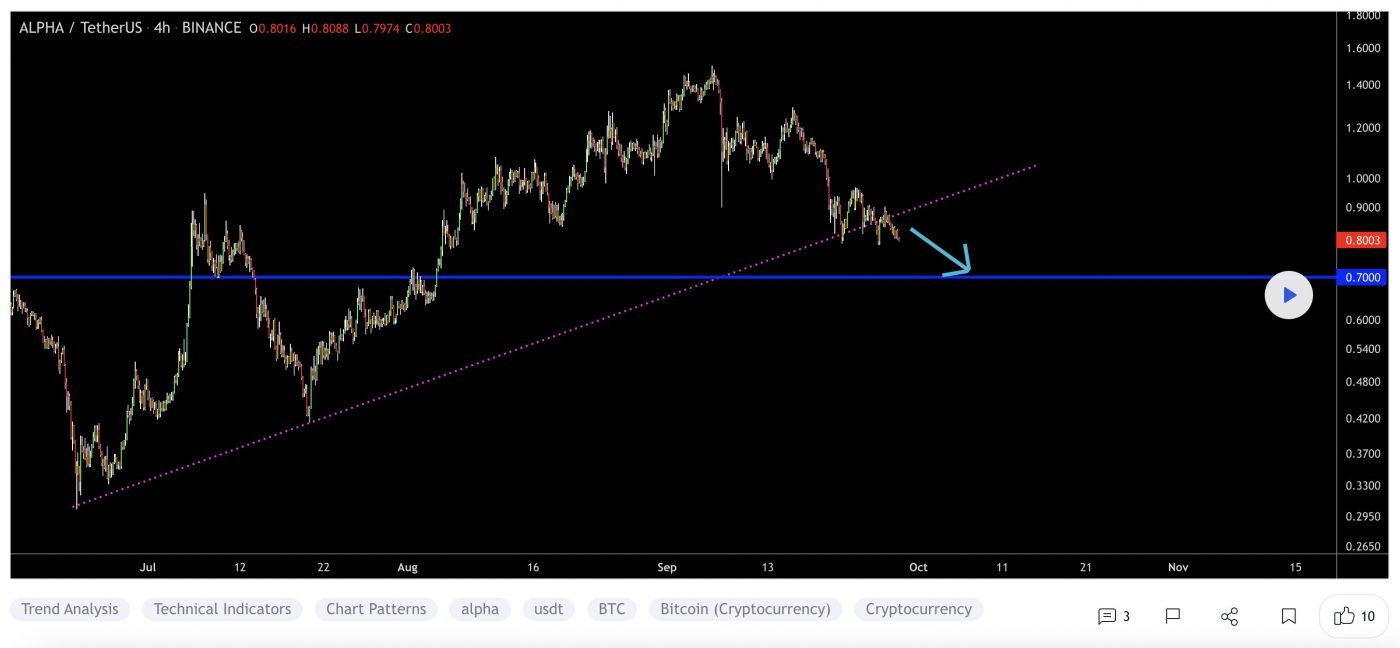

At the time of writing, ALPHA is ranked the 143rd cryptocurrency globally and the current price is A$1.20. Let’s take a look at the chart below for price analysis:

APLHA’s massive May spike retraced near A$0.6833 into the consolidation that began the impulse before bouncing to A$0.8265.

This consolidation could provide support again, although bears would first have to push the price through possible support near A$1.05. The market’s structure may be shifting bearish, with A$1.27 likely to provide some resistance if this is the case. A sustained bearish move could reach the swing low near A$0.9477 before finding support near A$0.8590.

However, the bullish higher-timeframe trend might prevail, with relatively equal highs near A$1.32 potentially giving an attractive target to lure the price over the monthly open. If so, the price could reach the midpoint near A$1.45.

3. ARPA Chain (ARPA)

ARPA is a blockchain-based layer 2 solutions for privacy-preserving computation, enabled by Multi-Party Computation (“MPC”). Founded in April 2018, the goal of ARPA is to separate data utility from ownership and enable data renting. ARPA’s MPC protocol creates ways for multiple entities to collaboratively analyze data and extract data synergies while keeping each party’s data input private and secure. Developers can build privacy-preserving dApps on blockchains compatible with ARPA. Some immediate use cases include credit anti-fraud, secure data wallet, precision marketing, joint AI model training, and key management systems.

ARPA Price Analysis

At the time of writing, ARPA is ranked the 406th cryptocurrency globally and the current price is A$0.06861. Let’s take a look at the chart below for price analysis:

ARPA set a high near A$0.1688 in April before retracing nearly 83% to find a low near A$0.0427. The price consolidated around this level before the strong bullish impulse during the last several weeks.

Probable resistance near A$0.06988 is slowing the bullish advance down. However, another leg might target the last swing high at A$0.07351 and relatively equal highs at A$0.07733. Resistance near A$0.07954 could cap the move before the second swing high. Beyond these levels, little stands in the bulls’ way before reaching the swing high near A$0.08290.

A retracement before a move higher might find support in the daily gap near A$0.06574, just above the monthly open. Relatively equal lows near A$0.06130 could also provide support. A run-on stops at A$0.05944 and A$0.05820 might find support in the gap beginning near A$0.05687 or a high-timeframe level near A$0.05177.

Where to Buy or Trade Altcoins?

These coins have high liquidity on Binance Exchange, so that could help with trading on AUD/USDT/BTC pairs. And if you’re looking at buying and HODLing cryptos, then Swyftx Exchange is an easy-to-use popular choice in Australia.

Disclaimer:

The content and views expressed in the articles are those of the original authors own and are not necessarily the views of Crypto News. We do actively check all our content for accuracy to help protect our readers. This article content and links to external third-parties is included for information and entertainment purposes. It is not financial advice. Please do your own research before participating.

Credit: Source link