Let’s take a closer look at today’s altcoins showing breakout signals. We’ll explain what the coin is, then dive into the trading charts and provide some analysis to help you decide.

1. Kava.io (KAVA)

Kava.io KAVA is a cross-chain DeFi lending platform that allows users to borrow USDX stablecoins and deposit a variety of cryptocurrencies to begin earning a yield. The Kava DeFi hub operates as a decentralised bank for digital assets, allowing users to access a range of decentralised financial services, including its native USD-pegged stablecoin USDX, as well as synthetics and derivatives. Through Kava, users are able to borrow USDX tokens by depositing collateral, effectively leveraging their exposure to crypto-assets.

KAVA Price Analysis

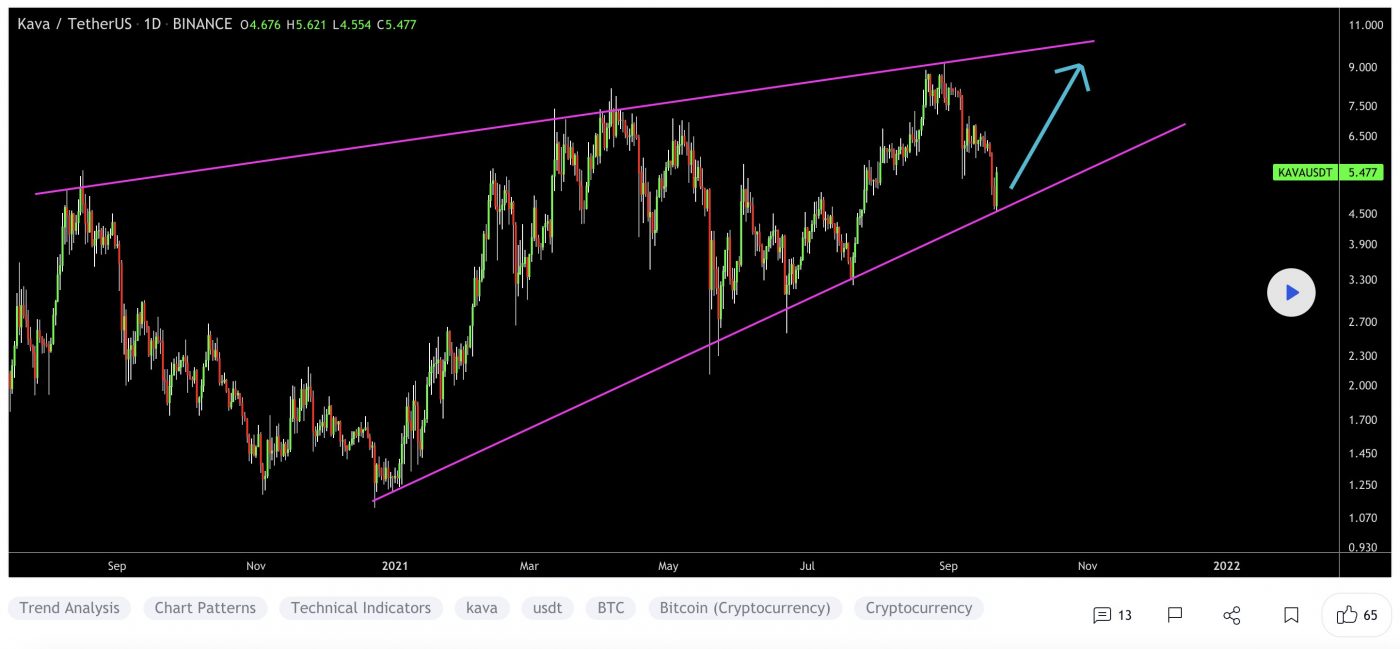

At the time of writing, KAVA is ranked the 124th cryptocurrency globally and the current price is A$7.64. Let’s take a look at the chart below for price analysis:

During August, KAVA broke several swing highs that could be the signal for a new bullish trend.

Last week’s break of the most recent swing low could suggest some downside in the short term. It formed probable resistance near A$7.33 and may target the swing low and possible support near A$7.05.

The swing low and possible support near A$6.89 could be the second bearish target if the move down continues. The relatively equal lows near A$6.22 and possible support underneath near A$6.45 could provide more substantial support.

The last swing high near A$7.93 gives a near-term target if bullish continuation continues. However, resistance beginning around A$8.26 could cap this move. A break of this resistance might continue to probable resistance near A$8.65 and reach above the cluster of relatively equal highs near A$9.34.

2. 1inch (1INCH)

1INCH is a decentralised exchange (DEX) aggregator, connecting several DEXes into one platform to allow its users to find the most efficient swapping routes across all platforms. In order for a user to find the best price for a swap, they need to look at every exchange — DEX aggregators eliminate the need for manually checking, bringing efficiency to swapping on DEXs. 1inch launched its 1INCH governance token, and the 1inch Network began to be governed by a decentralised autonomous organization (DAO).

1INCH Price Analysis

At the time of writing, 1INCH is ranked the 124th cryptocurrency globally and the current price is A$3.72. Let’s take a look at the chart below for price analysis:

May marked a turning point for 1INCH, with the price rocketing up almost 175% from its lows to probable resistance beginning near A$5.13.

The price is currently struggling with the area between A$4.25 and A$3.47. This region could provide support after a close above – or resistance after a close below.

A retracement could reach into the daily gap and possible support around A$3.41. A more bearish shift in the marketplace will likely aim for the relatively equal lows near A$3.25, and the potential support just below that begins around A$3.08.

Continuation to the upside will likely target the monthly high near A$3.90. However, probable resistance beginning at A$4.32 and A$4.77 could cap or slow down this move.

3. Terra (LUNA)

Terra LUNA is a blockchain protocol that uses fiat-pegged stablecoins to power price-stable global payments systems. According to its white paper, Terra combines the price stability and wide adoption of fiat currencies with the censorship-resistance of Bitcoin and offers fast and affordable settlements. Terra’s native token, LUNA, is used to stabilize the price of the protocol’s stablecoins. LUNA holders are also able to submit and vote on governance proposals, giving it the functionality of a governance token.

LUNA Price Analysis

At the time of writing, LUNA is ranked the 12th cryptocurrency globally and the current price is A$48.56. Let’s take a look at the chart below for price analysis:

In July, LUNA also turned the corner, breaking a key swing high in mid-August. This move could suggest a longer-term bullish trend.

The swing high near A$53.02 stands out as a bullish target and marks an area of probable resistance. Further continuation could reach into possible resistance starting near A$59.68.

Even if the bullish trend continues, a stop run at the recent swing low near A$46.12 into possible support beginning near A$42.32 is reasonable. If the price reaches further down, the swing low and possible support near A$39.60 might provide another downside target.

The area near A$38.24 could also provide support. However, a drop this far could suggest a stop run below the higher-timeframe relatively equal lows near A$36.48 into possible support beginning around A$34.57.

Where to Buy or Trade Altcoins?

These coins have high liquidity on Binance Exchange, so that could help with trading on AUD/USDT/BTC pairs. And if you’re looking at buying and HODLing cryptos, then Swyftx Exchange is an easy-to-use popular choice in Australia.

Disclaimer:

The content and views expressed in the articles are those of the original authors own and are not necessarily the views of Crypto News. We do actively check all our content for accuracy to help protect our readers. This article content and links to external third-parties is included for information and entertainment purposes. It is not financial advice. Please do your own research before participating.

Credit: Source link