Some Ethereum (ETH) miners are preparing for “a show of force” on April 1, standing against the implementation of the much-discussed Ethereum Improvement Proposal (EIP) 1559 by aiming to put at least 51% of Ethereum’s computing power into a single pool.

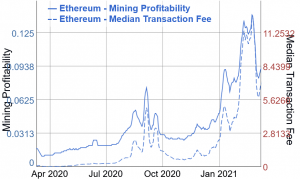

A group of miners is once again on the move to try and block the proposal that is expected to bring automatic setting of fees and token burn mechanism for each transaction, in an attempt to resolve the major issue of high transaction fees on Ethereum. That said, it’s also estimated that it would have a major impact on the miners’ revenue. And while some stood against the proposal before, some analysts claim that the large majority of miners would support it anyway.

Now, a group called for a new battle. For example, Red Panda Mining called for a collective move of hash power to one pool, Ethermine, with what seems like a strong support in the comments, though it can’t be said how many miners exactly are for or against this move.

For educational purposes, let’s collectively move our hash to https://t.co/6osh2Op6yl April 1st for 51 hours. @etherchain_org @BitsBeTrippin @SonOfATech @maxvoltage @SavageMine @VoskCoin @Nemisist2 @notyournormalm1 @BrandonCoin1 @GuntisVitolins #eip1559 #stopeip1559 #Ethereum

— Red Panda Mining (@RedPandaMining) March 7, 2021

“There is a call to arms/force projection taking place on April 1st of many home and mid-size miners moving hashrate over to Ethermine.org for 51 hours,” said the video description by Michael Carter of miner YouTube channel with 55,900 subscribers, Bits Be Trippin.

It’s done “to show a coordinated move of hash power that has been dismissed by the Ethereum Core Developers as their efforts to pay as little as possible to secure Ethereum’s network is well within the risk [boundary] on making changes to the monetary (fee) structure for Ethereum,” Carter said.

Several things are of note here, besides April 1 being Fool’s Day, if that has any meaning: the number 51 is significant in the Cryptoverse, given that controlling 51% of power results in controlling the network.

However, Carter argued that reaching this percentage is not about attacking the network or holding it hostage, and that miners have no incentive to do so. Any movement towards 51% in the pool which currently holds 20% of hash power, he said, shows that “focusing of power can occur,” and that “force projection is possible.”

The rapid drop of fees may lead to incentive misalignment, argued Carter, resulting in a series of effects that would then disincentivize miners, but incentivize attackers. The move of hash power, he said, is a move to prevent that, and to try to protect Ethereum and miners from existential and other risks. The intentions, Carter said, are to show: “Hey, you guys think you’re protected, and you want to pay the least amount for security, there needs to be an understanding of the way the fees are distributed.”

The other thing of note is that Ethermine is one of the pools that have voiced their opposition to the EIP. Spark Pool, which accounts for 23.8% of the network’s hashrate, is also on the opposers’ list. If Ethermine were to get 60%-70% of hash power, Carter said, it would send “a clear message that there needs to be a compromise.”

As reported, EIP-1559 is accepted and is set to be included in the London network upgrade, estimated in July this year.

But there is an obvious division and difference in opinions between these miners and the rest of the ecosystem, to put it in general terms. While miners claim they fight for their earned profits and the security of the network, many outside the group support EIP-1559, with some even calling the miners “greedy” and “selfish.”

Some said that this may turn users away from the network altogether. “If miners are looking to completely kill the golden goose, this would be it. Showing people that a 51% attack could be mounted that easily and quickly is the surest way to get people to move their projects off Ethereum as quickly as possible,” wrote ‘dado3.’

Meanwhile, others are arguing that many investors are not even aware of mining/miners.

I get this 100%, but we cant just sit back and take it. Hopefully people will pass the word to there friends to sell there eth before it happens. When its over in 51hrs buy your share back. We are not trying to hurt anyone. Just making a stand.

— Tavioli (@TavioliThe3rd) March 7, 2021

At 10:35 UTC, ETH is trading at USD 1,756. It dropped 4% in a day, and appreciated 11% in a week.

____

Learn more:

– Ethereum Miners Are Likely to Accept EIP-1559 Activation – Analysts

– EIP-1559 Won’t Lower High Ethereum Fees On Its Own – Professor

– ETH ‘Insanely Cheap,’ DeFi To Rally, BTC Dominance to Drop – Pantera Capital CIO

– What’s in Store for Ethereum in 2021?

– Too Costly Ethereum is Pushing DeFi Users Away, Fuelling BNB Rally

– Ethereum Miners Don’t Cause Price Volatility, Says Analyst

Credit: Source link