New research on the Ethereum blockchain has revealed at least $318M worth of ETH was made in profits through DeFi bot arbitrage trading since the beginning of 2020.

The data shows that the technique has netted at least $57M USD (47,600 ETH) in January 2021 and at least $107M USD for February 2021. Before analysing a couple of real-world cases, here is a quick primer on the theory.

What is Triangular Arbitrage?

In plain English, the price of the cryptocurrencies can vary across different exchanges and you can swap them to make a profit.

Triangular arbitrage (also referred to as cross-currency arbitrage or three-point arbitrage) is the act of exploiting an arbitrage opportunity resulting from a pricing discrepancy among three different currencies […]. A profitable trade is only possible if there exist market imperfections. Profitable triangular arbitrage is very rarely possible because when such opportunities arise, traders execute trades that take advantage of the imperfections and prices adjust up or down until the opportunity disappears.

Wikipedia

Highly-volatile new DeFi crypto markets provide market imperfections which don’t often exist in Forex exchange markets – creating opportunities for arbitrage traders.

Let’s now take a look at recent examples of Triangular Arbitrage trades.

Real Trading Example #1

This trade uses the programmable DeFi liquidty pools of Uniswap and Balancer and the 3 coins: USDC (stablecoin), OPT, and AKRO.

The trading steps:

- Swap USDC for OPT on Uniswap

- Swap OPT for USDC on Balancer

- Swap USDC for AKRO on Balancer

- Swap AKRO for USDC on Uniswap

The numbers:

- $1,431 USDC in

- $1,615 USDC out

- $84 USDC profit (after $100.62 USD fees deducted)

As you can see, there was a profit made by selling on one platform, swapping and then buying on the other platform. It is also worth noting that currently DeFi transactions are fees are very high, but they still made a profit.

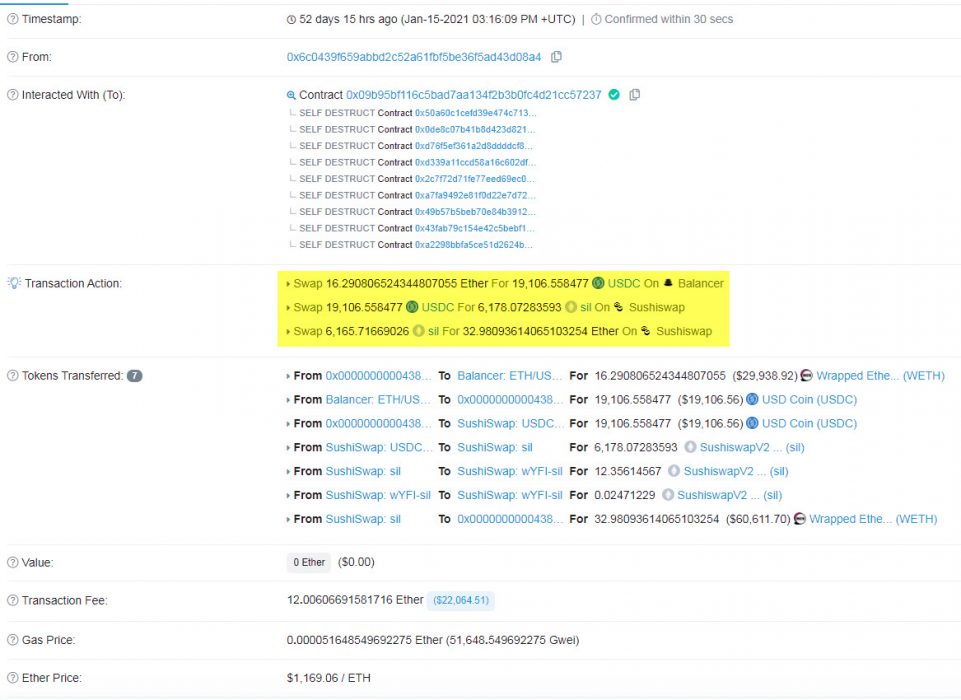

Real Trading Example #2

This example is slightly different to the first one, as this trade uses SushiSwap and Balancer and the 3 coins: USDC (stablecoin), ETH, and SIL (an old ICO coin called Silvar Coin).

The trading steps:

- Swap ETH for USDC on Balancer

- Swap USDC for SIL on Sushiswap

- Swap USDC for ETH Sushiswap

The numbers:

- $29,938 USD worth of ETH in

- $60,611 USD worth of ETH out

- $8,609 USDC profit (after $22,064 USD fees deducted)

What makes this trade different is that the contract has SELF DESTRUCT sub-contracts attached where the sender continuously re-bids the same trade but at higher GAS fees to protect it from other trading bots that noticed the same opportunity. This has a bi-product negative effect on the Ethereum blockchain by have pushing up the GAS fee ridiculously high and congesting the network.

DeFi Exchanges Usage

The majority of profits are being made using Uniswap with 47% of the total trades, followed by Sushiswap 22%, Balancer 13% and dYdX 9.4%.

Further Arbitrage Trade Musings

As the Ethereum blockchain is public, these arbitrage trades can be tracked and there is a website called Flashbots which has a leaderboard showing all the recent trades.

Here are some interesting ones:

- This successful trade on Uniswap between $AKRO, $PICKLE, $CREAM, $YFI, $KP3R, $SUSHI and $YPIE turning 3 ETH into 153 ETH, with a profit of $188,867 USD (including a massive $13,021 USD transaction fee!)

- This successful trade on Uniswap between $ETH, $UDO and $USDT turning 0.4 ETH into 59 ETH, with a profit of $78,836 (including a massive $17,667 USD transaction fee!)

- This failed trade on Cream Finance where the sender ran out of GAS while trying to attempt an arbitrage trade. Luckily (or so) there was another trader waiting and their trade was successful in capturing the arbitrage opportunity making around $5,362 USD profit.

Averting the ETH Network Congestion Crisis

As the Ethereum community tries to improve the network, there is a proof of concept being developed to help the solve the problem of trading bots congesting the network by prioritising the transactions. If you want to contribute there is a public discussions board on Github.

Further Reading

Disclaimer:

The content and views expressed in the articles are those of the original authors own and are not necessarily the views of Crypto News. We do actively check all our content for accuracy to help protect our readers. This article content and links to external third-parties is included for information and entertainment purposes. It is not financial advice. Please do your own research before participating.

Credit: Source link