Let’s take a closer look at today’s altcoins showing breakout signals. We’ll explain what the coin is, then dive into the trading charts and provide some analysis to help you decide.

1. Litecoin (LTC)

Litecoin LTC is a cryptocurrency that was designed to provide fast, secure, and low-cost payments by leveraging the unique properties of blockchain technology. The cryptocurrency was created based on the Bitcoin protocol but it differs in terms of the hashing algorithm used, hard cap, block transaction times and a few other factors. Litecoin has a block time of just 2.5 minutes and extremely low transaction fees, making it suitable for micro-transactions and point-of-sale payments.

LTC Price Analysis

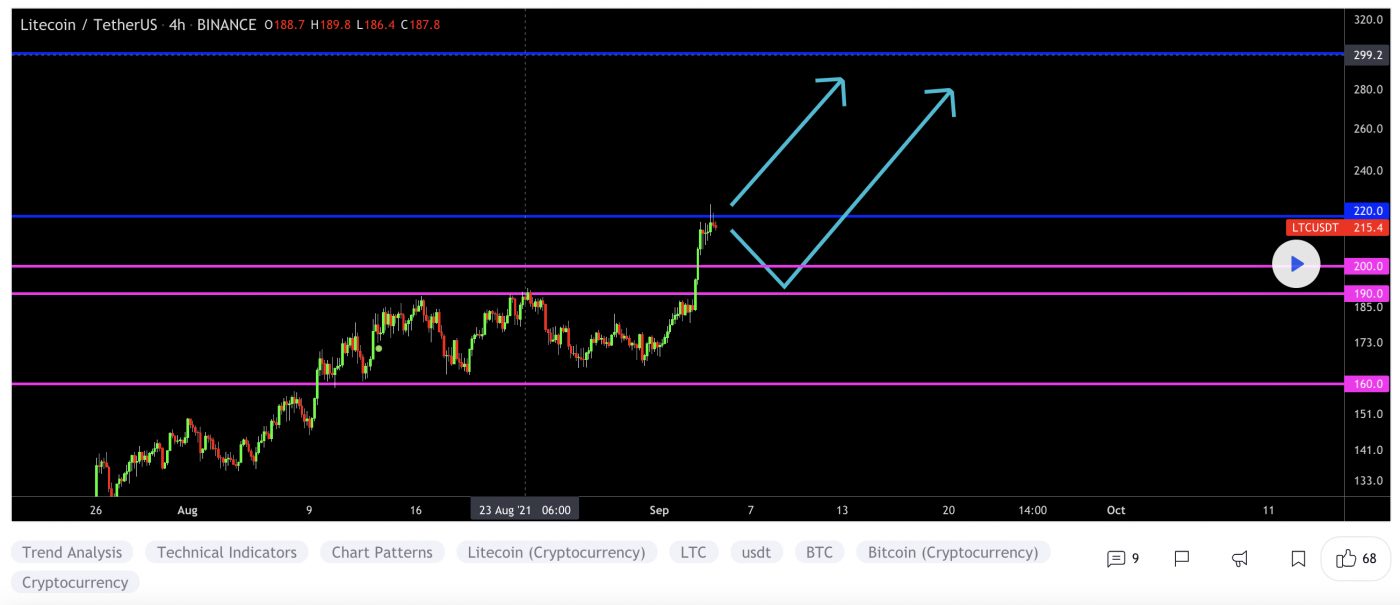

At the time of writing, LTC is ranked the 12th cryptocurrency globally and the current price is A$305.19. Let’s take a look at the chart below for price analysis:

After dropping nearly 70% in May, LTC found a low just above July’s monthly gap near A$195. Since then the price has been consolidating in a range between A$273 and A$300.

The weekly level near A$290 may continue to provide support during a run on the local swing lows. The monthly gap beginning near A$265 will likely give the next higher-timeframe support if this level fails.

The price is currently chewing into potentially strong resistance near A$315. A sweep of the relatively equal highs near A$342, and a daily close above this level, could signal a move to the next set of relatively equal highs near A$379.

Just above these highs, probable resistance rests near A$392, which may cap the price until the market moves out of consolidation. However, any significant bullish shift in market conditions during the next few weeks could help bulls reach the swing high near A$410, running stops into probable resistance near A$431.

2. Fio Protocol (FIO)

Fio Protocol FIO is a blockchain protocol that aims to enable a better way of sending/receiving coins and tokens. The FIO token is the native utility token of the project’s blockchain infrastructure, FIO Chain, and is used for transaction gas fees and on-chain governance. The FIO Chain uses a Delegated Proof-of-Stake (DPoS) to achieve network consensus. Block Producers are elected by FIO token holders via on-chain voting. Anyone can register to become a BP and produce blocks if they receive enough votes.

FIO Price Analysis

At the time of writing, FIO is ranked the 441st cryptocurrency globally and the current price is A$0.3246. Let’s take a look at the chart below for price analysis:

FIO accompanied the rest of the market in the mid-Q2 drop, falling nearly 85% from its mid-May high until it found a low late in June.

Price action in late June formed a weekly support level near A$0.2076, which has so far held up the price. The most recent swing low inside this range, near A$0.2877, might be the target for any future stop runs. After this low, the swing low near A$0.2677 and the gap beginning near A$0.2543 mark possible higher-timeframe support.

The price is currently battling with significant higher-timeframe resistance levels, with the closest probable resistance resting near A$0.3697, just over the June monthly open. A sweep of the relatively equal highs above this resistance might find sellers near A$0.3806 – but could reach as high as A$0.4188.

3. Eos (EOS)

EOS is a platform that’s designed to allow developers to build decentralised apps, known as DApps for short. The project’s goal is relatively simple: to make it as straightforward as possible for programmers to embrace blockchain technology and ensure that the network is easier to use than rivals. As a result, tools and a range of educational resources are provided to support developers who want to build functional apps quickly.

EOS Price Analysis

At the time of writing, EOS is ranked the 29th cryptocurrency globally and the current price is A$8.18. Let’s take a look at the chart below for price analysis:

EOS has been trading through a massive range since April, with the price showing mild bullishness during August.

The breaks of the swing highs at A$7.78 and A$7.50 led to support forming near A$6.95. Some bulls will likely wait for a more favourable entry on a potential stop run that could reach near A$6.74.

If the support near A$6.50 continues to hold, the recent swing high at $9.68 is likely the next short-term target. This potential bullish swing might end with a run on short stops up to A$10.15 and A$10.46.

Higher-timeframe resistance between A$11.29 and A$11.46 may cap any move upwards until the overall market becomes more bullish. However, any significant bearish move in Bitcoin will likely push the price down toward the low and possible support near A$7.12.

Where to Buy or Trade Altcoins?

These coins have high liquidity on Binance Exchange, so that could help with trading on AUD/USDT/BTC pairs. And if you’re looking at buying and HODLing cryptos, then Swyftx Exchange is an easy-to-use popular choice in Australia.

Disclaimer:

The content and views expressed in the articles are those of the original authors own and are not necessarily the views of Crypto News. We do actively check all our content for accuracy to help protect our readers. This article content and links to external third-parties is included for information and entertainment purposes. It is not financial advice. Please do your own research before participating.

Credit: Source link