The bitcoin golden cross is a highly anticipated technical indicator that typical foreshadows bullish price action. Bitcoin analysts, investors and traders are looking closely at current price movements which at present suggest a strong push is imminent in the coming weeks.

What is the Golden Cross?

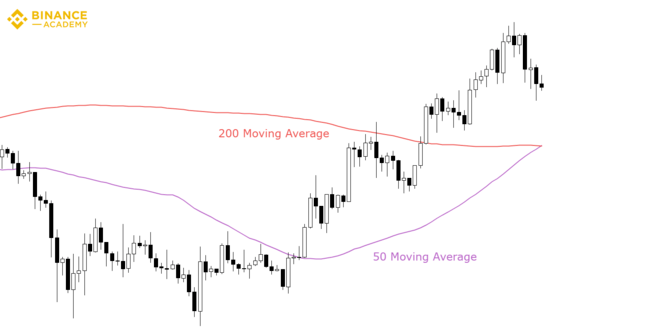

According to Binance Academy, a golden cross is a chart pattern where a shorter-term moving average (MA) crosses above a longer-term moving average. This is typically considered to be a bullish signal.

A golden cross occurs in three phases:

- There’s a downtrend where the shorter-term MA is below the longer-term MA.

- The market reverses and the shorter-term MA crosses over the longer-term MA.

- A continued uptrend starts and the shorter-term MA stays above the longer-term MA.

When considering a golden cross, the most commonly used moving averages are the 50- and 200-day periods. Once the crossover happens, the longer-term moving average is typically considered to be a strong area of support.

The opposite of a golden cross is a death cross, where a shorter-term moving average crosses below a longer-term moving average. This is typically considered to be a bearish signal.

Potential Signs of Bitcoin Golden Cross

The chart below illustrates the potential intersection between the blue line (50-day MA) and black line (200-day MA), signalling a potential golden cross. Notice the inverse (death cross) that occurred towards the end of June highlighting a market crippled by fear.

Analysts suggest that a golden cross so soon after a death cross would create a “face-melting pump” reminiscent of the 2013 and 2017 bull cycles.

Rekt Capital, one of the more active technical analysts on Twitter, suggests it may well happen within days.

Will US$50,000 Prove to Be a Strong Resistance Level?

Despite the bullish talk of golden crosses and positive on-chain metrics, others have been more circumspect suggesting that bitcoin first needs to overcome the psychological barrier of US$50,000.

At this point, momentum appears to have shifted towards the bulls. Well-known podcaster Scott Melker seems to think so too and offers some interesting insights into the current market dynamics.

Disclaimer:

The content and views expressed in the articles are those of the original authors own and are not necessarily the views of Crypto News. We do actively check all our content for accuracy to help protect our readers. This article content and links to external third-parties is included for information and entertainment purposes. It is not financial advice. Please do your own research before participating.

Credit: Source link