Let’s take a closer look at today’s altcoins showing breakout signals. We’ll explain what the coin is, then dive into the trading charts and provide some analysis to help you decide.

1. Polkadot (DOT)

Polkadot DOT is an open-source sharding multichain protocol that facilitates the cross-chain transfer of any data or asset types, not just tokens, thereby making a wide range of blockchains interoperable with each other. The Polkadot protocol connects public and private chains, permissionless networks, oracles, and future technologies, allowing these independent blockchains to trustlessly share information and transactions through the Polkadot relay chain,

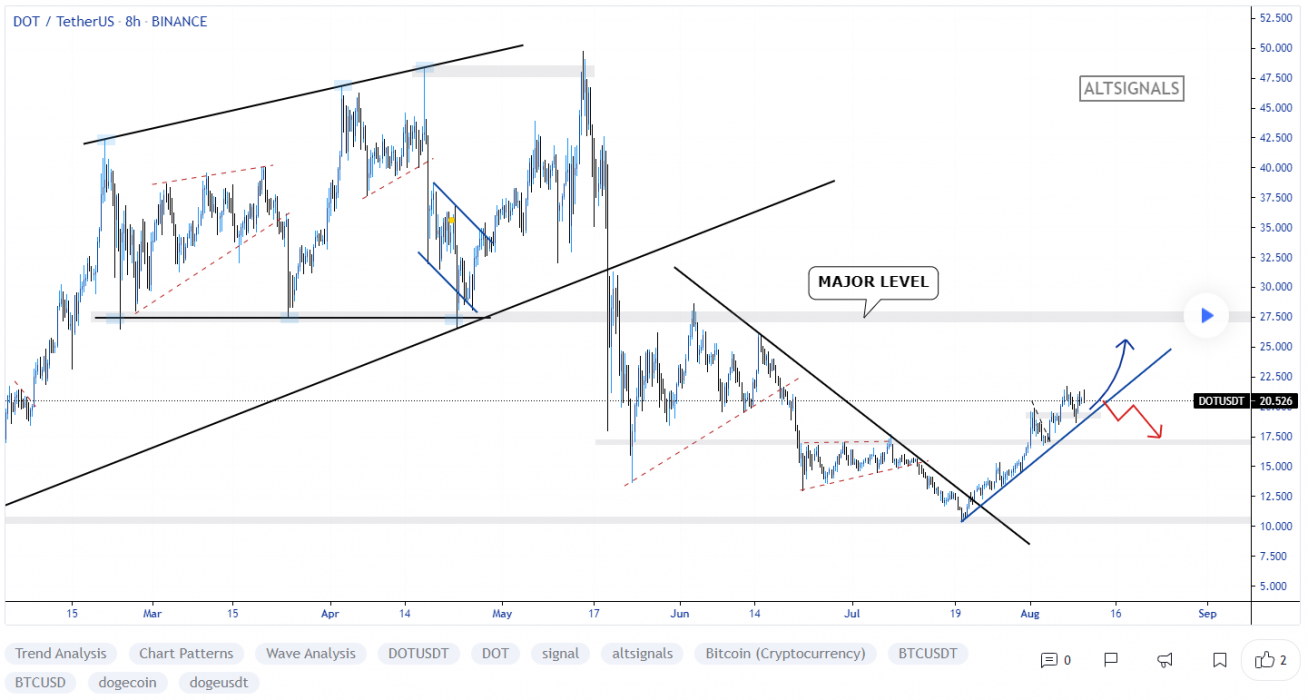

DOT Price Analysis

At the time of writing, DOT is ranked the 9th cryptocurrency globally and the current price is A$28.02. Let’s take a look at the chart below for price analysis:

After its early Q2 bullrun, DOT has been ranging between approximately A$21.05 and A$32.45.

Last week’s sharp decline ran equal lows into a gap on the daily chart. This down move could set the stage for an attack on the relatively equal highs near A$29.34 if the price can break probable resistance near A$32.78 and A$34.21.

Above these highs, resistance near A$39.54 could halt a bullish move, although reaching the monthly high at A$45.32 is possible.

Aggressive bulls might look for entries in possible support near A$25.86 and A$24.00, just below the current price. If the price sweeps last week’s low, the levels near A$23.59 and A$21.48 may also provide support.

2. Tezos (XTZ)

Tezos XTZ is a blockchain network that’s based on smart contracts, in a way that’s not too dissimilar to Ethereum. However, there’s a big difference: Tezos aims to offer infrastructure that is more advanced — meaning it can evolve and improve over time without there ever being a danger of a hard fork. This is something that both Bitcoin and Ethereum have suffered since they were created. People who hold XTZ can vote on proposals for protocol upgrades that have been put forward by Tezos developers.

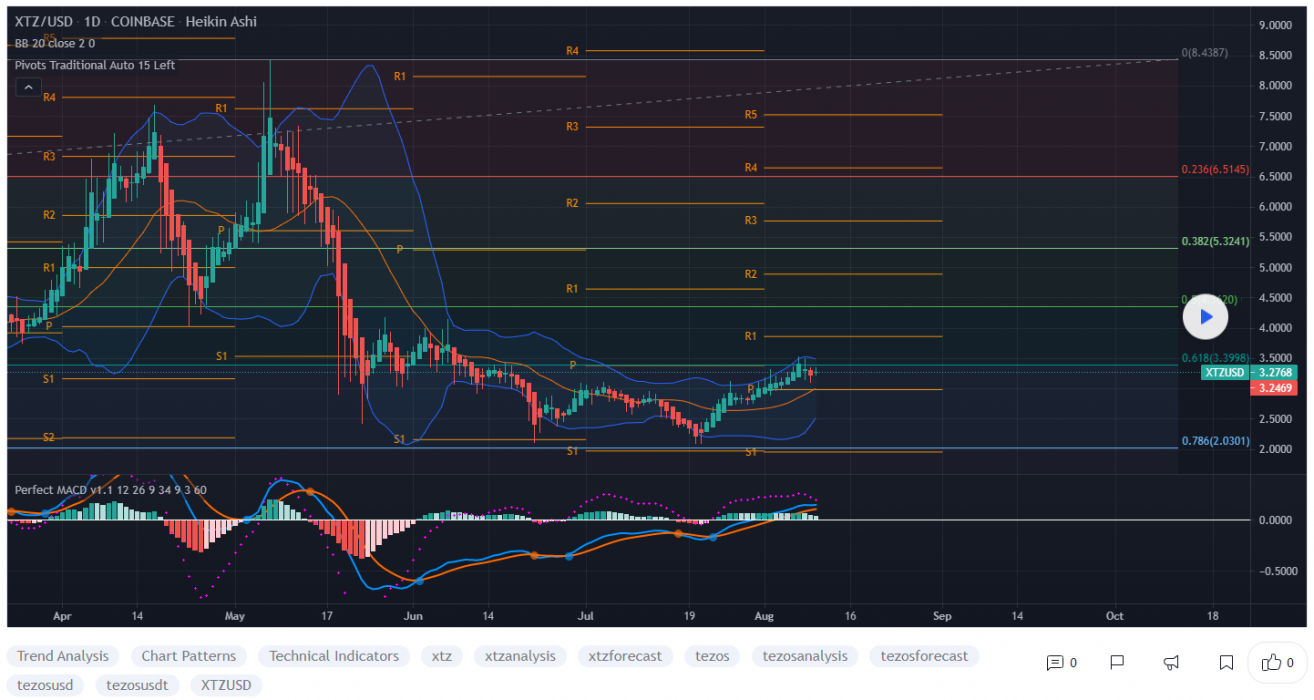

XTZ Price Analysis

At the time of writing, XTZ is ranked the 45th cryptocurrency globally and the current price is A$4.35. Let’s take a look at the chart below for price analysis:

XTZ’s spectacular May pump has retraced most of its gains as it finds support near A$3.47.

Stops under the relatively equal lows near A$4.12 might be swept, along with the swing low near A$3.89. If this sweep happens, the price could find support near A$3.55. A move further down could find more support near A$3.27.

Spikes upward are likely to encounter resistance beginning near A$4.88. If the bullish trend resumes after re-accumulation, some traders might take profits as the price approaches probable resistance starting around A$5.13 and A$5.38.

The monthly near A$6.12 provides a clear first primary target. Any price moves beyond this level are challenging to predict from current price action for the short-term trade.

3. MIOTA (IOTA)

IOTA is a distributed ledger with one big difference: it isn’t actually a blockchain. Instead, its proprietary technology is known as Tangle, a system of nodes that confirm transactions. The foundation behind this platform says this offers far greater speeds than conventional blockchains and an ideal footprint for the ever-expanding Internet of Things ecosystem.

IOTA Price Analysis

At the time of writing, IOTA is ranked the 47th cryptocurrency globally and the current price is A$1.30. Let’s take a look at the chart below for price analysis:

The second half of May punished IOTA bulls with a nearly 72% drop before the price found support near an old swing low around A$1.05.

Aggressive bulls might look for entries at possible support beginning near A$1.15. However, stops under the equal lows near A$0.9355 are likely to be swept.

The area near A$1.00 provides a possible target for this stop run if it occurs. A more sustained bearish trend could reach down to the broad zone of possible support between A$0.8945 and A$0.8236.

The price is currently challenging resistance at a gap beginning near A$1.49. If this level breaks, bulls could find more resistance near A$1.65 while targeting the highs up to A$1.77.

A sweep of these highs is likely to find resistance by the time price reaches the area near A$1.96. The next reasonable targets would be the swing highs and resistance near A$2.31 and A$2.54.

Where to Buy or Trade Altcoins?

These coins have high liquidity on Binance Exchange, so that could help with trading on AUD/USDT/BTC pairs. And if you’re looking at buying and HODLing cryptos, then Swyftx Exchange is an easy-to-use popular choice in Australia. However, you can also buy these coins from different exchanges listed on Coinmarketcap.

Disclaimer:

The content and views expressed in the articles are those of the original authors own and are not necessarily the views of Crypto News. We do actively check all our content for accuracy to help protect our readers. This article content and links to external third-parties is included for information and entertainment purposes. It is not financial advice. Please do your own research before participating.

Credit: Source link