Despite what may have been presumed, non-fungible token (NFT) activity is far from dead, and actually seems to be picking up speed – with rich investors, or whales, spending millions on artwork, NFTs selling for millions a piece, and the trading volumes going up again.

“The rise of NFTs is similar to what we’ve seen in TradFi [traditional finance] markets for 2 decades,” said Jeff Dorman, Chief Investment Officer of US-based investment management firm Arca. “While Bitcoin is a great asset, it’s no longer representative of the asset class as other sectors are leading the way forward.”

Per his recent post, the NFT ecosystem remains red hot.

Following last year’s decentralized finance (DeFi) summer, some call this “NFT summer.”

NFTs have been launched by celebrities, athletes, musicians, and other popular individuals – even popular beauty brand NARS – one of the latest being Mila Kunis’ adult comedy animated series named “Stoner Cats,” starring Ethereum (ETH) co-founder Vitalik Buterin. NFTs are even grabbing the interest of corporations for business use cases.

Crypto exchange FTX, for example, is partnering up with entertainment company Dolphin Entertainment to launch an NFT marketplace for prominent sports and entertainment brands.

As this is underway, news are spreading throughout the Cryptosphere of an Ethereum whale buying up pixelated images known as CryptoPunks, which have gained great popularity in the crypto space, particularly as there are only 10,000 of them.

A wallet shows 104 CryptoPunks purchases made last Friday and Saturday, spending millions on them. The last Punk was purchased for ETH 29 (USD 72,125), for example.

And there is an offer for sale of a rare Punk, one of nine Alien Punks – currently priced at ETH 35,000, or USD 87m, or more than was paid for the famous Beeple’s NFT, sold on Christie’s.

According to dapp (decentralized application) data aggregator and analysis firm DappRadar, the CryptoPunks NFT collection has completely dominated the Top 10 NFT Sales over the past week, with the top Punk selling for more than USD 5.4m, setting a new benchmark for CryptoPunks sales.

Serial entrepreneur Gary Vaynerchuk acquired another a Punk for ETH 1,600 (currently USD 4m).

Another five punks sold for USD 1m or more. Meanwhile, someone made nearly USD 1m flipping ‘Punk 6649’ within 24 hours. It sold first for USD 1.04m (ETH 450), and then changed hands again a day later for USD 1.99m (ETH 810).

The cheapest punk on the market now costs ETH 33 (USD 82,203), per DappRadar.

Due to several big purchases, CryptoPunks saw its trading volume increase 1,223% in one week to more than USD 121m.

According to a new NFT Leaderboard published by blockchain analytics firm Nansen in late July, the number one NFT collector on this list is Pranksy, with a total profit of ETH 1,573 (USD 3.93m), and a total spend of ETH 1,860 (currently USD 4.65m) – three times the amount of anyone else on the leaderboard.

Other key players include ‘atblank.eth’, ‘Danny’, and ‘snotrocket.eth’.

Meanwhile, another internet meme has been tokenized as an NFT, and sold for a substantial amount of money. In September 2015, Muhammad Asif Raza announced to the world on Facebook that “Friendship ended with Mudasir. Now Salman is my best friend.” This NFT sold on August 1 for ETH 20 (USD 49,878) to Andrew Kang, co-founder of crypto investment firm Mechanism Capital, on NFT marketplace Foundation.

Other meme-turned-NFTs include the ‘Overly Attached Girlfriend’ and the ‘Disaster Girl’.

Rise across the board

Besides CryptoPunks, other collections like Art Blocks, Bored Ape Yacht Club, and Meebits have seen their trading volumes rise 321%, 193%, and 632%, respectively, said DappRadar.

The biggest NFT collection is still gaming project Axie Infinity, the trading volume of which has increased 12% in a week to more than USD 170.5m. But the average price of an Axie NFT is USD 558, significantly lower than a Punk.

OpenSea, a major NFT marketplace, saw some USD 95m in trading volume over the past weekend, which is some 4.5 times more than during the entire 2020, or as CEO Devin Finzer tweeted:

“The growth curve for NFTs is insane.”

As recently reported, unicorn OpenSea said it raised USD 100m in a round led by Andreessen Horowitz (a16z), valuing the company at USD 1.5bn and bringing more capital to fuel NFT adoption.

Per Jeff Dorman, OpenSea daily volume on August 1 eclipsed USD 53m, which is 8x the volume for the entire month of January, and 30%-50% of the monthly volumes for every month from January until July.

Furthermore, NFT volumes as a whole are beginning to eclipse their March peak, “with projects across the board receiving a significant increase in demand.”

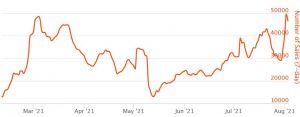

Number of weekly sales

__

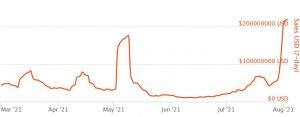

Value of weekly sales, USD

__

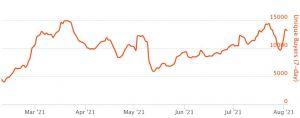

Weekly unique buyers

__

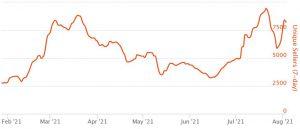

Weekly unique sellers

Where there’s buying, there’s stealing

But the world of NFTs has its dark side too.

The co-founder of NFT game Hedgie, Stazie, tweeted that they lost their CryptoPunks and “a bunch of ETH.” As the Twitter thread says, Stazie clicked on a Discord link, thinking it’s related to CryptoPunks, with a popup appearing that looked like the Metamask wallet “saying something like the security was compromised, and asking to enter the seed phrase to restore the wallet connection to the site.”

This is a well-known method of stealing somebody’s seed phrase and emptying their wallets. Never give out your seed phrase.

Stazie was able to save some artworks and WETH, saying: “There was zero critical thinking, and this is beyond idiotic. The punks and ETH [were] quickly gone before I could do anything.”

The thief’s wallet now holds 10 CryptoPunks. The account lists 5 more Punks as sold for ETH 194.04 (USD 370,491).

____

Reactions:

This NFT frenzy should tell you something about how much cash is available and ready to go full ape as soon as mark… https://t.co/XTUodtI5cA

__

__

Absurd amount of money flowing in, major NFT floor price increase 50% , is top signal or a new NFT season is gonna… https://t.co/t1iHTFs1pq

____

Learn more:

– Damien Hirst’s NFT Art Project: What We’ll Discover When It’s Over

– NFTs Are Selling for Millions, But How Do You Tell a Diamond From a Dud?

– Why NFTs Aren’t Just for Art and Collectibles

– Consider These Legal Questions Before Spending Millions on NFTs

– NFT Performance Art: Corporations Could Capitalize On Protest

– NFT Explosion Coming over Next 2 Years & Will Create Jobs, Say Insiders

– Why Would Anyone Buy NFT – A Link To A JPEG File?

– Money Laundering Might Taint NFTs Too, Prepare For Tighter Controls

Credit: Source link