The text below is an advertorial article that was not written by Cryptonews.com journalists.

The sharp pullback and the amount of time Bitcoin has spent looking weak has gotten many traders worrying that the current bull market cycle has run its course and that we are moving into a bear market.

While recent short-term price trajectory looks bearish, two historical data that plots the movement of Bitcoin in previous bull runs are suggesting that the current bull market is far from over.

These two data are the Mining Fee Reward Schedule and Historical ROI Cycle.

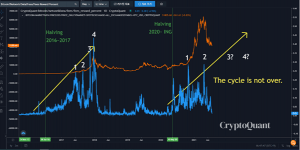

Mining Fee Reward Ratio Suggests Bull Market Not Over

After every Bitcoin halving, block rewards decrease and thus, the amount of mining fee rewarded as a ratio of the entire network revenue increases. Analysing the pattern of Bitcoin mining fee reward ratio trajectory can help us determine which stage of the halving cycle we are in. From the diagram below, we can see that the ratio usually goes up in 4 unique bursts, each creating a higher high, with the price of the Bitcoin cycle top coinciding with the 4th burst in fee reward ratio, and thereafter, falling sharply as Bitcoin moves into a bear market. The current halving cycle has only seen 2 similar peaks, which means we are lacking in the other 2 peaks and could potentially still see another 2 bursts in fee reward ratio before price starts to move into a bear market. This could suggest that the BTC current bull market may not be over since we have yet to see the final 2 higher bursts in mining reward ratio.

This phenomenon has a logical explanation when referencing it with the current situation with regards to BTC mining.

Current mining fee reward ratio has plunged because of the big drop in hashrate caused by the great mining migration out of China. While sounding bearish, this drop in fee reward ratio appears to be part and parcel of its swings witnessed in the 2017 bull cycle as well. In the 2017 cycle, the fee reward ratio has fallen sharply with each burst, only to fully recover and go higher in the next burst. Hence, even though the China mining exodus news sounds like a one-of-its-kind development, its impact statistically isn’t out of norm. Previous bull cycles have witnessed similar falls but recovered soon after.

For our current situation, the drop in hashrate and fee reward ratio will also definitely recover as more miners relocate and plug their machines back, which experts estimate should take around 6-months. The current lull therefore is temporary and Bitcoin hashrate is on the mend as we speak, and will be back to where it was by the end of this year (assuming it takes miners up to 6-months to do the migration according to experts). That could be when the final 2 bursts in fee reward ratio start to happen.

In other words, despite many claims that China has ended this year’s bull run with its mining ban, historical data is proving otherwise.

With 2 peaks still forthcoming in the current bull run, this China mining exodus could merely be putting in a temporary consolidation period, thereby lengthening the duration of the bull run, rather than ending it.

Another interesting metric seems to concur with my theory of the bull run merely being lengthened.

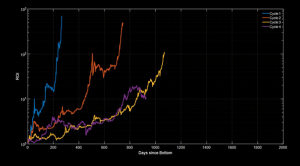

Historical ROI Cycle Shows That We Are Only At Mid-Cycle

According to the historical ROI of Bitcoin, the current bull cycle, should it already have ended, will be the shortest one with the lowest ROI, and has peaked sooner than it is supposed to as shown by the purple chart below.

If we use the historical curvature of the previous 3 bull runs as a guide, each new bull cycle ought to play out over a longer duration, taking a greater number of days to hit each new peak. However, the purple chart which depicts the current bull run has moved way too fast and peaked too soon with reference to cycle 3 of 2017 (in yellow) should it really be the cycle peak. Thus, it would seem like the current BTC price pullback is merely moving it back to its proper place, lengthening the number of days it takes till it reaches its next parabolic move up, likely to be near the 1200-day mark based on my extrapolation.

Should this pattern really play out, this bull cycle should have at least another 300 days before it reaches its peak at around middle of next year, and the current pullback is nothing more than a consolidation that has happened with each cycle. This consolidation period ties in perfectly with the China mining exodus that is lengthening the duration of the current bull run by forcing the market to consolidate by around 6 months, which experts think is the time it takes for the affected miners to plug their machines back in and let hashrate recover to its level before. Only when hashrate recovers will we be able to see the 3rd burst in mining fee reward ratio and continue the bull run.

Historical data and events unfolding seem to tie in very well to suggest that the market could consolidate around 6 months (we are already 3 months in) before Bitcoin price moves back above 64,000 USD and resume higher. Should 2 more bursts in mining fee reward ratio be in the works, and following the trajectory of the historical ROI, the price per Bitcoin could be hitting around 150,000 USD this time next year.

About Kim Chua, PrimeXBT Market Analyst

Kim Chua is an institutional trading specialist with a track record of success that extends across leading banks including Deutsche Bank, China Merchants Bank, and more. Chua later launched a hedge fund that consistently achieved triple-digit returns for seven years. Chua is also an educator at heart who developed her own proprietary trading curriculum to pass her knowledge down to a new generation of analysts. Kim Chua actively follows both traditional and cryptocurrency markets closely and is eager to find future investment and trading opportunities as the two vastly different asset classes begin to converge.

Credit: Source link