Get your daily, bite-sized digest of cryptoasset and blockchain-related news – investigating the stories flying under the radar of today’s crypto news.

____

Regulation news

- New Jersey regulators are giving crypto lender BlockFi an extra week before its ban on the creation of new interest-bearing accounts will take effect, Zac Prince, the BlockFi founder and CEO, confirmed. The state’s Bureau of Securities claims that these accounts are unregistered securities, but the company maintains that they are not.

- Meanwhile, Alabama Securities Commission (ASC) Director Joseph Borg announced that the ASC has issued a Show Cause Order to BlockFi, which will give them 28 days to show cause why they should not be directed to cease and desist from selling unregistered securities in Alabama. The regulator claims that the BlockFi Interest Account (BIA) is an unregistered security, as does the equivalent authority in New Jersey, while the company maintains that this is not the case.

- The Bank of Russia said that they recommend that Russian exchanges not admit for trading Russian and foreign securities where payments depend on exchange rates of cryptocurrencies, prices for foreign digital financial assets, dynamics of indexes of cryptocurrencies and cryptoassets, as well as prices of cryptoderivatives and securities of cryptocurrency funds.

Economics news

The Governing Council of the European Central Bank said it expects the key ECB interest rates to remain at their present or lower levels until it sees inflation reaching 2% well ahead of the end of its projection horizon and durably for the rest of the projection horizon, and it judges that realized progress in underlying inflation is sufficiently advanced to be consistent with inflation stabilizing at 2% over the medium term. “This may also imply a transitory period in which inflation is moderately above target,” they added. ECB President Christine Lagarde also promised that the bank has learned from the errors of past crises and won’t derail the current economic recovery by withdrawing emergency support too early, per Bloomberg.

Investments news

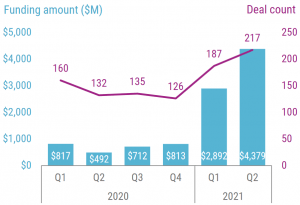

Funding for blockchain startups reached USD 4.38bn for the first time in the second quarter, compared with USD 2.89bn in the first quarter, analytics firm CB Insights said. The number of deals increased from 187 to 217 in the same period of time.

Source: CB Insights - Fund manager Global X Digital Assets has filed for a bitcoin exchange-traded fund (ETF) with the US SEC. The filing stipulates that the trust itself “will not purchase or, barring a liquidation or extraordinary circumstances described herein, sell bitcoin directly.”

- Venture studio Thesis said it has completed a USD 21m Series A fundraise from investors such as ParaFi Capital, Nascent, Fenbushi Capital, Polychain Capital, and Draper Associates, among others. Thesis is the venture builder behind crypto projects such as Fold, Keep, Saddle and open source initiatives like tBTC (wrapped BTC).

NFTs news

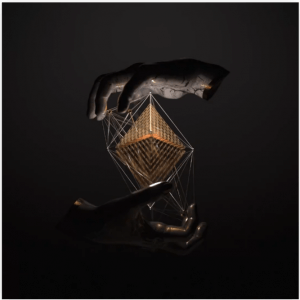

Ethereum (ETH)-focused Stateful Works said they are issuing EIP-1559 NFTs [non-fungible tokens] “as an experiment in providing cultural prestige & economic upside to EIP-1559 Contributors.” All proceeds from NFT minting are trustlessly forwarded to EIP-1559 contributors using a split contract,” they added. For example, the 1559 Supporter Series has 1559 editions, each priced at .1559 ETH, while “a premium one-of-one: the 1559 Patron Edition” will be on auction for 155.9 hours from the moment the reserve price of 15.59 ETH is met.

Source: stateful.mirror.xyz

CBDCs news

- The Reserve Bank of India is considering a “phased introduction” of a central bank digital currency as it will need legal changes to be made in the nation’s foreign-exchange rules and information-technology laws, Bloomberg reported, citing Deputy Governor T. Rabi Sankar.

Stablecoins news

An audit for Tether (USDT) may be months away, the company’s general counsel Stuart Hoegner told CNBC. However, he also said that they currently don’t have a date in mind, but that it is “in process.”

- Paxos (PAX) has unveiled their reserves backing the stablecoin, showing that 96% of their reserves are held in cash and cash equivalents, while 4% are in US Treasury bills.

Mining news

- Bitcoin mining infrastructure provider Mawson Infrastructure Group has announced it has taken delivery of 250 Bitmain Antminer S19 Pros and expects a further 570 Avalon A1246 miners from Canaan to be delivered and operational before the end of July, and expects an additional 588 Avalon A1246 miners to be delivered in early August.

Legal news

- Payments app Robinhood said it expects to pay a USD 30m penalty in relation to an anti-money laundering probe of its cryptocurrency business, according to a filing with the US Securities and Exchange Commission (SEC). An investigation found alleged violations of anti-money laundering and New York Banking Law requirements, “including the failure to maintain and certify a compliant anti-money laundering program.”

- Joseph O’Connor, a British man, was arrested in Spain on suspicion of hacking the Twitter accounts of Apple, US president Joe Biden, former president Barack Obama, and billionaires Elon Musk, Warren Buffett, and Bill Gates, among others, to promote a BTC scam, per CNBC.

Payments news

- Coinbase Commerce, the exchange’s e-commerce platform, said it has added dogecoin (DOGE) as an accepted form of payment.

- Blockchain technology company Blockstream has announced Greenlight, their newest Lightning Network service. It provides access to the Lightning Network, helping users to spin up their Lightning node in the cloud while retaining control over their funds.

- Fiat-to-crypto and payment infrastructure company Wyre has partnered with Polygon (MATIC), allowing developers to provide Polygon’s USDC token to their customers via the Wyre Checkout API. The integration will be available worldwide and in 43 US states.

- Layer-2 scaling solution Celer Network (CELR) has announced that its multi-chain network, cBridge v1.0, is now live on the mainnet. The update will allow users to transfer tokens across Ethereum, Arbitrum, Polygon, and Binance Smart Chain (BSC).

Career news

- Solidus Labs, a crypto-native risk monitoring, market surveillance, and fraud-prevention specialist, said it has appointed Kathy Kraninger, former Director of the US Consumer Financial Protection Bureau, as their new Vice President of Regulatory Affairs. The company recently announced a USD 20m A round of funding.

Credit: Source link