It took nearly three years for US-based crypto company Circle, the issuer of major stablecoin USD Coin (USDC), that is preparing to go public, to finally reveal how this token is backed.

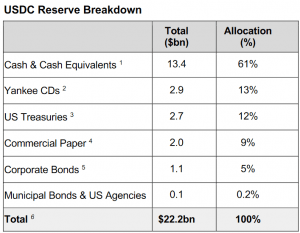

In their latest attestation report, prepared by auditors at Grant Thornton, the company said that, on May 28, cash and cash equivalents (e.g. securities) comprised 61% of their reserves.

Per the auditors, the total fair value of US dollar-denominated assets held in segregated accounts are at least equal to the USDC in circulation at the report date.

“Since nearly three years ago when the first USDC entered circulation, Circle, together with Centre Consortium, have prioritized trust, transparency, and accountability,” Jeremy Allaire, Founder and CEO of Cirlce, said in a statement.

He added that as USDC in circulation “has grown more than 2,600% since the beginning of 2021, so too has our own commitment (along with external calls) to enhanced transparency of the composition of dollar-denominated assets.”

We are thinking about ways to share this in an on-chain, Oracle-linked format, as well as expanding and publishing… https://t.co/ClSndJHn9j

“Finally, as we march towards becoming a listed company, we will be filing quarterly audited financials and management disclosures that will be required as an SEC-regulated public company, and will include USDC reserve composition disclosures similar to our attestations,” Allaire added.

____

Learn more:

– USDC Operator Happy After Yellen Calls Stablecoins ‘National Security’ Concern

– USDC Issuer Circle To Debut On NYSE, Promises More Transparency

– Skeptics Keep Tether Busy Despite Latest Transparency Round

Credit: Source link