Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Este artículo también está disponible en español.

Bitcoin is facing a crucial test as its price continues to swing without clear direction, navigating a tense and uncertain macroeconomic environment. While volatility persists, many analysts believe the worst phase of the correction may be over. After dropping over 30% from its all-time high, Bitcoin has managed to hold above key support levels, reinforcing short-term optimism.

Related Reading

However, global tensions—driven by escalating trade disputes and aggressive tariff policies from the US—are shaking financial markets. The specter of a global recession looms large, making investors cautious across both traditional and digital asset classes.

Despite the noise, on-chain data from Glassnode adds a layer of optimism. According to their latest analysis, 63% of Bitcoin’s circulating supply has not moved in at least one year. This historic level of dormant supply highlights the growing conviction among long-term holders, who are weathering the current volatility without panic.

Such behavior reinforces the belief that Bitcoin’s foundation remains solid, even as short-term traders exit the market. The strong hands are holding firm, and their resilience could lay the groundwork for the next major move—once macroeconomic conditions begin to stabilize.

Bitcoin Holds Strong Amid Global Volatility: Rising Long-Term Conviction

Massive price swings continue to shake both crypto and equities markets as volatility intensifies in response to rising global tensions and unresolved macroeconomic threats. Bitcoin, however, has held strong above the $81K level, suggesting that a potential recovery may be taking shape.

The 90-day pause on U.S. tariffs—excluding China—offered temporary relief, but uncertainty still dominates investor sentiment. Ongoing trade conflicts between the United States and China threaten global economic stability, with many analysts warning of a potential recession if no resolution is reached. These fears are weighing heavily on risk assets across the board.

Despite the challenging backdrop, Bitcoin’s performance suggests underlying resilience. Bulls are gradually regaining momentum after the recent sharp correction, and many market watchers believe the worst phase of the drawdown may be over.

Adding to the optimism, top analyst Quinten Francois shared Glassnode data revealing that 63% of the Bitcoin supply has not moved in at least a year. This metric, often associated with strong long-term conviction, shows that the majority of Bitcoin holders are choosing to hold through volatility rather than sell into weakness. It reflects a maturing investor base with confidence in Bitcoin’s long-term value, even amid global uncertainty.

If current support levels continue to hold and macro conditions stabilize, Bitcoin may be on the verge of a sustained recovery.

Related Reading

BTC Price Stalls Below Key Resistance After Bullish Surge

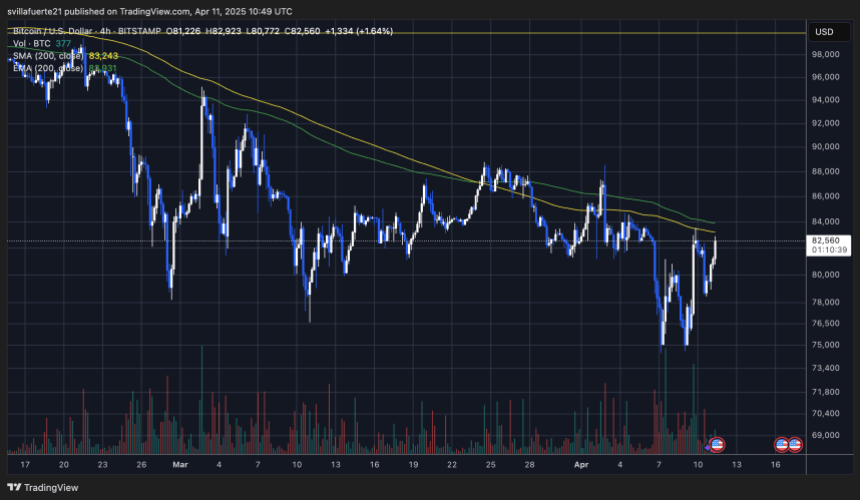

Bitcoin is currently trading at $82,600 following a strong surge that helped the asset recover from recent lows. The move has brought some short-term optimism to the market, especially as BTC managed to reclaim the $81K level—a key support zone that now needs to hold for bullish momentum to continue.

However, significant resistance lies ahead. The price stopped near the 4-hour 200 Moving Average, currently sitting around $83,500. This technical level has consistently acted as a short-term barrier since Bitcoin lost the $100K mark, and bulls need a decisive breakout above it to confirm the beginning of a true reversal.

If Bitcoin can break and hold above $83,500, the next immediate target is the $85K zone. Reclaiming that range could open the path for a push toward the $88K–$90K resistance band and potentially resume the longer-term uptrend.

Related Reading

On the flip side, failing to hold above $81K would signal weakness and likely invite renewed selling pressure. A breakdown below $80K would reinforce bearish sentiment, possibly triggering a fresh wave of panic selling and sending BTC back toward the $75K support zone. Bulls must act quickly to defend current levels and push higher.

Featured image from Dall-E, chart from TradingView

Credit: Source link