A new report from on-chain analytics firm Glassnode has described current market conditions as a “bear of historic proportions”, adding that “it can reasonably be argued that 2022 is the most significant bear market in digital asset history”:

This Year BTC’s Worst on Record?

Following Glassnode’s recent report arguing we were in “the darkest phase of the bear market“, its latest release, titled “A Bear of Historic Proportions”, outlines reasons for believing that 2022 has been the worst on record for Bitcoin.

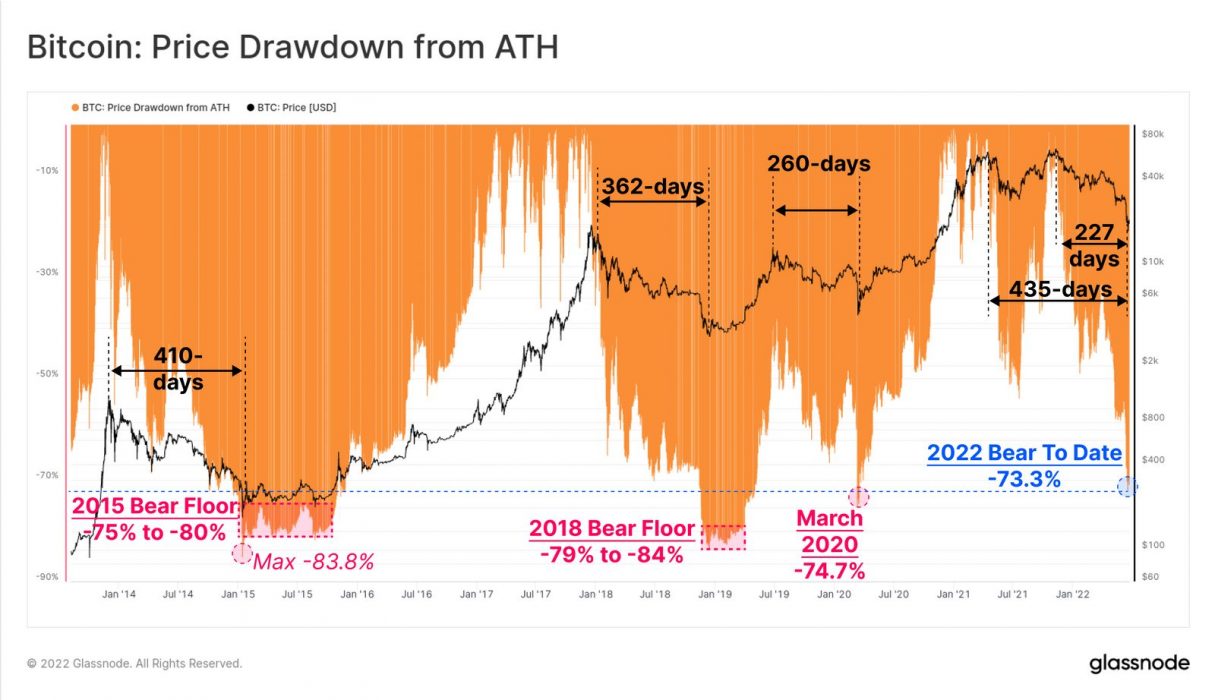

Interestingly, according to the blockchain analysis firm, the bear market commenced in April 2021 and not November 2021, since “a large proportion of the marginal buyers and sellers were flushed from the market”. It adds that bear market lows typically have drawdowns between -75 percent and -84 percent from the all-time high (ATH), taking between 260 and 410 days.

With the current drawdown reaching -73.3 percent below the November 2021 ATH, Glassnode concludes that “this bear market is now firmly within historical norms and magnitude”:

Mayer Multiple in Rare Territory

One of the clearest signs of a bear market is when the spot price of bitcoin drops below the 200-day moving average (MA) and, in seldom seen cases, below the 200-week MA.

To illustrate, Glassnode uses the Mayer Multiple (MM), a metric used to identify bear and bull markets. Simply put, when prices are below the 200-day MA it signifies a bear market, and when above the 200-day MA, a bull market. Currently, bitcoin’s price of around US$20,000 is at a very rare level, given that it is below half the 200-day MA:

Glassnode comments that falling below 0.5 MM is an extraordinarily rare event which hasn’t happened since 2015:

Only 84 out of 4160 trading days (2 percent) have recorded a closing MM value below 0.5. For the first time in history, the 2021-22 cycle has recorded a lower MM value (0.487) than the previous cycle’s low (0.511).

Glassnode report

Realised Price, Another Bear Signal

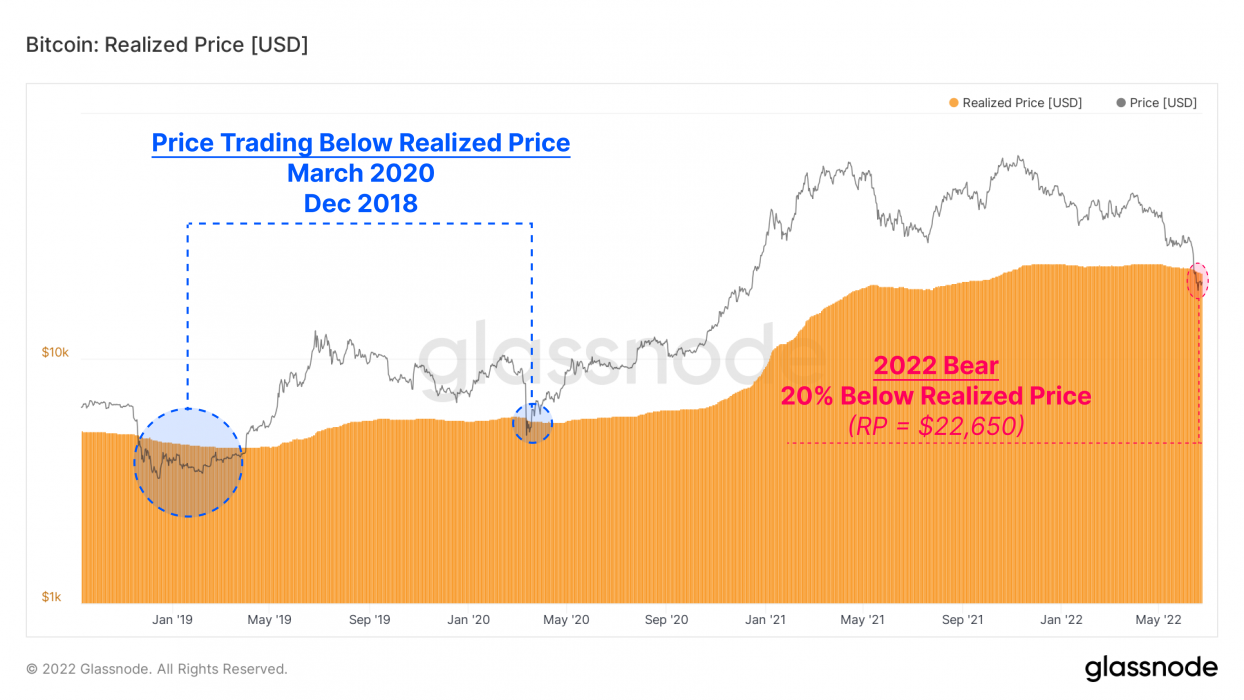

In addition to the MM, Glassnode also notes that Bitcoin’s spot price is trading below “Realised Price”, a valuation metric calculated by taking the value of all bitcoins and the price they were bought, divided by the number of bitcoins in circulation.

Glassnode notes that the current discount to Realised Price suggests that sellers are offloading their coins at a loss. This too is an uncommon phenomenon, as spot price has only traded below Realised Price five times since Bitcoin’s launch:

Spot prices are currently trading at an 11.3 percent discount to the realised price, signifying that the average market participant is now underwater on their position.

Glassnode report

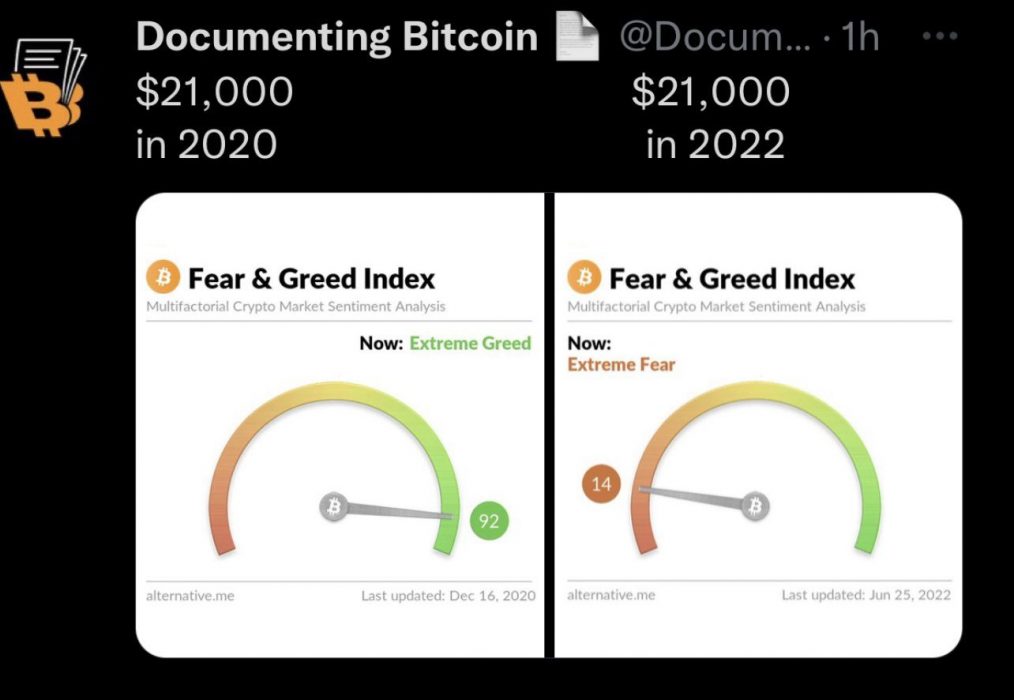

To highlight the severity of current market conditions, Glassnode concludes by saying that the “deviation from the MA is so large that only 2 percent of trading days have been worse off”. A bear market of historic proportions indeed. Then again, it’s all a matter of context:

Disclaimer:

The content and views expressed in the articles are those of the original authors own and are not necessarily the views of Crypto News. We do actively check all our content for accuracy to help protect our readers. This article content and links to external third-parties is included for information and entertainment purposes. It is not financial advice. Please do your own research before participating.

Credit: Source link